Best Markets for Highest Rent Growth

We now track, analyze and score median rents paid for Single Family Residential (SFR) properties. We also compute the rental growth RATES for virtually all State, City, County and Zip Code level markets.

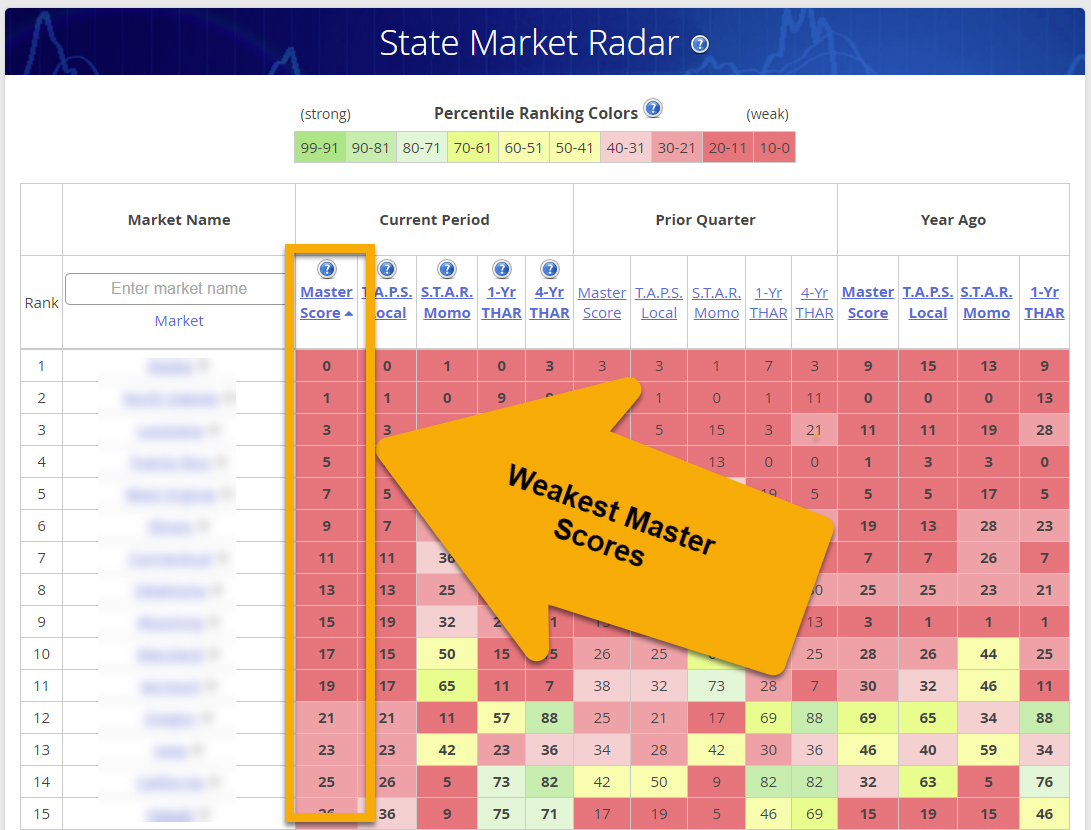

We then score and rank each market based on its rent growth and compare it to where it is in its appreciation cycle.