Market Breadth Improves Year-over-Year

62 U.S. Markets Lost Value Yr-over-Yr

Compared to last quarter, the total number of Year-over-Year declining markets has improved significantly!

Currently, 62 markets (15% of ALL U.S. real estate) experienced ‘real’ (inflation adjusted) declines over the last year.

Our last Y-O-Y report showed that 102 markets had ‘real’ home price declines (they didn’t even keep up with inflation).

Quarterly Market Data

Published July 18, 2017

List of the 171 DECLINING U.S. Real Estate Markets

Compared to last quarter, the total number of declining markets has improved slightly, but it’s still very alarming.

42% of all U.S. Real Estate Markets Declined Q-o-Q

Currently, 171 markets experienced ‘real’ (inflation adjusted) declines over the last three months.

Market Breadth Continues to Weaken Year-Over-Year

1/4th of U.S. Markets Lost Value Year-over-Year

It doesn’t feel right.

102 out of the 400 major real estate markets in the U.S. experienced ‘real’ decline in home value Year-Over-Year… they didn’t even keep up with inflation.

NO ONE is talking about this.

I’m not saying the sky is falling,

Market Breadth Getting Weaker

Half of all real estate

markets losing value Qtr-over-Qtr

Almost 1/5th of all markets losing value Yr-over-Yr

I just got back from a real estate mastermind conference; lots of very smart investors. NONE of them knew that nearly 1/5th of all major US real estate markets are now in decline.

They were blown away when I showed them the list (scroll down).

Real Estate Cycles

You’ve always heard real estate moves in cycles… but what does that mean?

More importantly, how can YOU profit from it?

As a general rule, prices for most things are stable (not cyclical) because changes in demand are quickly offset by adjusting supply. If you’re a widget manufacturer and more people want widgets,

Was the Last Real Estate Crash Truly Unique or Just a Blip On the Radar?

If you have lost significant money as an investor or personally, I know it never feels small. I’m sorry that happened to you.

There is something much bigger going on beneath the surface. Painting the recent real estate downturn as the “event of the century,” screaming that this has never ever happened before and that we will never ever recover from it makes for good headlines,

How All Real Estate Owners Lost $45k The Last Few Years

Why It Had NOTHING to Do With Your Investing Strategy

Did you lose a lot of money in real estate during the last down cycle? The answer, in all likelihood, is yes, you did. You didn’t have to!

See why here on my latest Real Estate Market Report

Look – there’s a time to be actively,

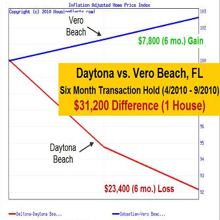

Real Estate Forecasting A Trip To The Beach

Choosing between Daytona and Vero beach, meant an additional $31,200 because of knowing their market cycles.

My Home Is Going To Double In Price And My Neighbor’s Will Be Worthless In Just 12 Months!

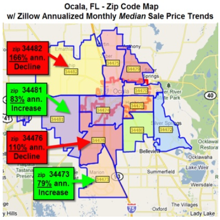

Zillow, Not Just A Crazy Name, It’s A Crazy Way To Look At Home Prices

Besides Fundamental Analysis, the other major blunder is trying to use “median” home prices to forecast local real estate cycles.

It’s what everyone tries to use because those numbers are readily available, and free. It was the only game in town.

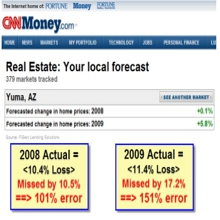

Ken Wade Vs. CNN

This next example is going to tick off the 600 pound gorillas in my space: FiServ Lending Solutions, along with CNN-Money.com and Fortune magazine.

FiServ handles all the big banks and Wall Street firms – I’m a little peon compared to them.

But what the hell, you deserve to know the truth… so here goes…

CNN teamed up with FiServ to publish a detailed local market analysis.

Total Market Master : Part 2

As “total market masters”, you’re no longer limited to only your local area. You can now invest anywhere in the country where your money will grow.

Leverage: The Power To Make You Millions Or Make You Broke! Part 1

Making money in real estate boils down to these three simple factors…

1) Leverage

2) Appreciation

3) Timing

Leverage & Appreciation are the cornerstones of all real estate wealth.

Timing is the variable that determines if you win, or if you lose.

Let’s look at Leverage…

Just about anyone can control a property with a relatively small amount of cash… or sometimes no cash at all… THAT’s WHY real estate investing makes such good late night infomercials… because any fool can sign on the dotted line and take control.