test widget inject

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

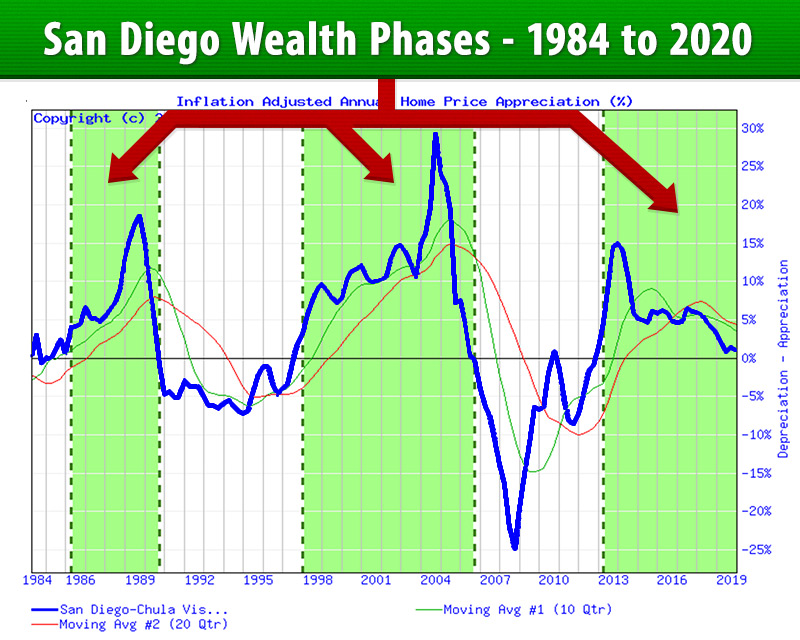

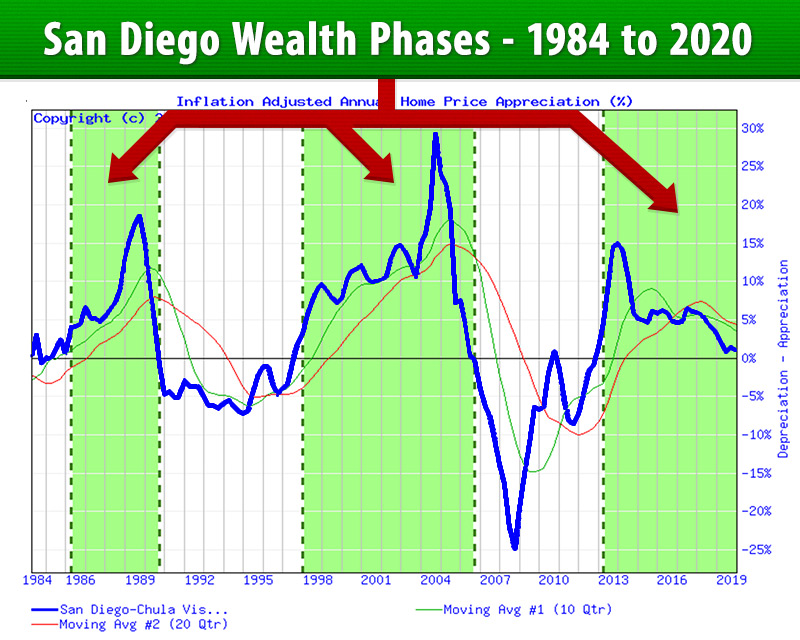

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

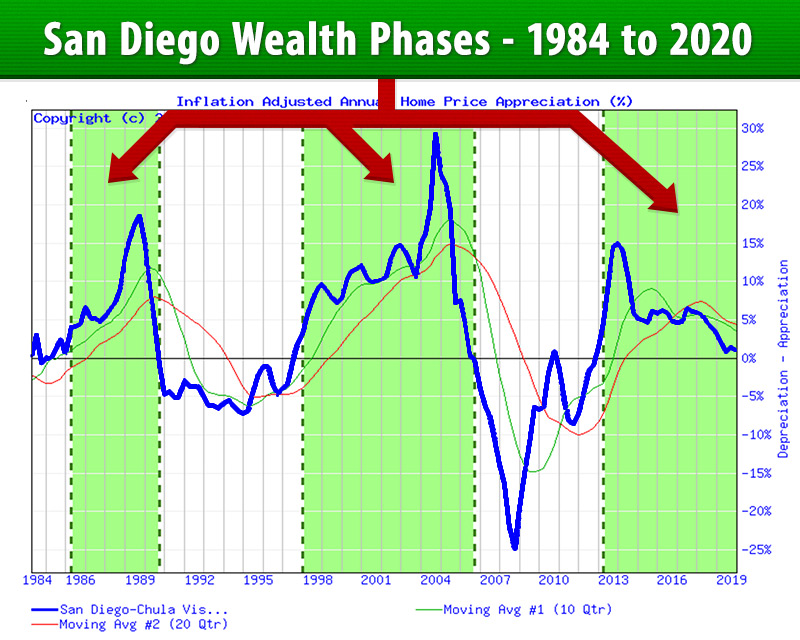

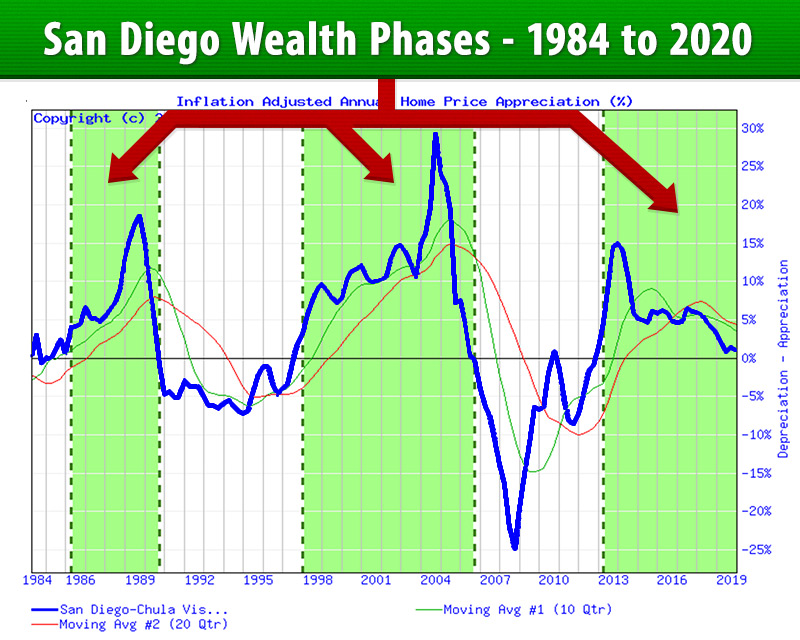

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

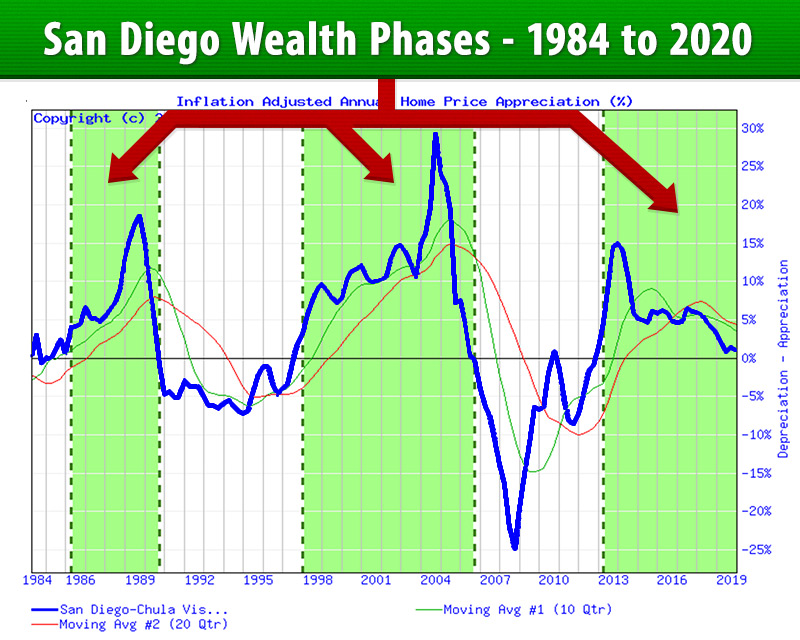

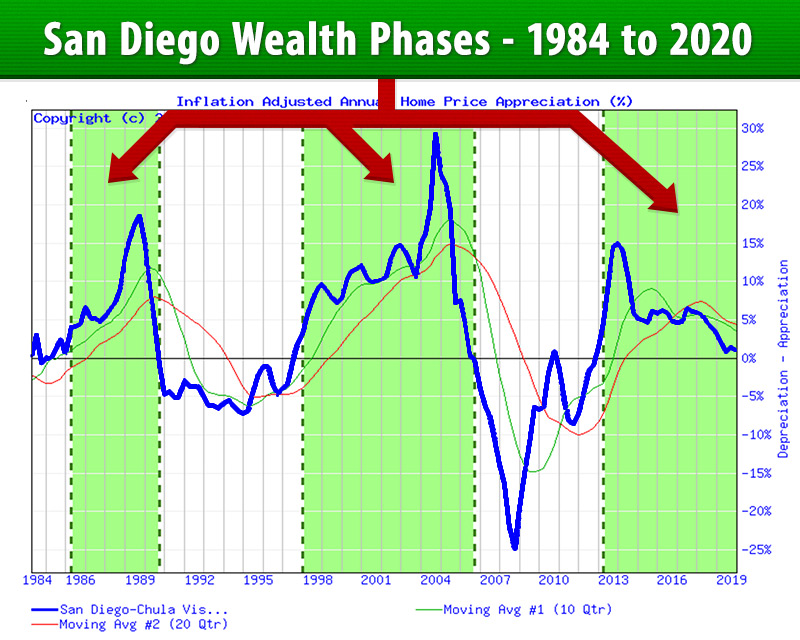

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Score (raw)

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

Phase

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

to view

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

S.T.A.R. Momentum Gauge

This indicator measures and ranks (as a percentile, relative to ALL markets nationwide) each market's momentum. Momentum is important, but a high momentum score does not, by itself, indicate a hot market. Momentum scores are 'long range' indicators that should be used along with raw master/hot market scores and Wealth Phase charts.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets. Use 'Raw" scores for measuring the absolute performance.

T.A.P.S. Local Gauge

This "LOCAL" Technical Analysis Point Score ranking isolates ONLY that particular market. It ignores any impact the broader market may have. For example, at the 'City' level, the TAPS score for it's State, Regional or National market is ignored.

The indicator below represents the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

1-Yr THAR Gauge

This indicator ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year. ‘THAR’ scores are ‘spot’ indicators that should be used with TAPS and Master Scores, not as stand-alone decision triggers.

The indicators below represent the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Every market can be scored and ranked by each Indicator below ('99' is strongest, '0' is weakest).

Master Score

This is the best single indicator (if you only want to look at ONE scoring element).

Cash Flow

The higher the score, the more likely this market will have higher cash flow compared to all markets nationwide.

Hot Market + Cash Flow Score

This indicator attempts to identify micro markets with both relatively higher cash flow potential AND a relatively higher potential for appreciation.

Rent Growth

A high score means SFR rent rates have been increasing more in this market, RELATIVE to all markets nationwide.

House Value

On a nationwide basis, lower priced properties tend to be in weak or flat markets with less likelihood for appreciation.

Technical Analysis Point Score

This is the Technical Analysis Point Score ranking after combining the Local (city-level) market with the State, Regional and National TAPS scores.

Six Trigger Alert Report

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum.

1-Yr THAR

This indicator ranks all markets based on its Total Home Appreciation Rate over the previous year.

Close Tab

Close Tab

Ranked State List

This state list is ranked based on the indicator selected in this widget.

It is ranked from Best to Worst markets.

| Rank | Market | Gross Rent Ratio |

| Rank | Market | Gross Rent Ratio |

| 1 | Hattiesburg, MS | 8.4 |

| 2 | Gulfport-Biloxi, MS | 8.1 |

| 3 | Jackson, MS | 7.9 |

| 4 | Memphis, TN-MS-AR | 7 |

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

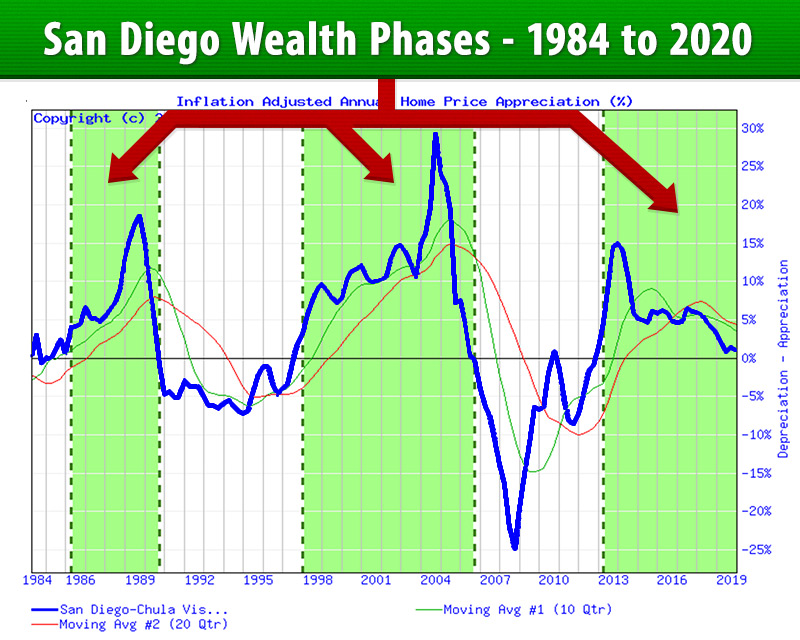

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

STAR Indicators

The STAR momentum indicators show the 'energy' behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six 'triggers' represent a distinct Technical Analysis (TA) 'event.'

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) 'growing' from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

STAR Momentum Indicators

Market Momentum (STAR) Indicators

City: Deltona-Daytona Beach-Ormond Beach, FL

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six ‘triggers’ represent a distinct Technical Analysis (TA) ‘event.’

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) ‘growing’ from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

| Short-Term | Mid-Term | Long-Term | ||||

| #1 | #2 | #3 | #4 | #5 | #6 | |

| Current Qtr |  |

|

|

|

|

|

| Prior Qtr |  |

|

|

|

|

|

| 2 Qtrs ago |  |

|

|

|

|

|

| 3 Qtrs ago |  |

|

|

|

|

|

| Year ago |  |

|

|

|

|

|

TAPS Indicators

The TAPS (Technical Analysis Point Score) indicator is an easy to understand, graphical way to show the results of complex Technical Analysis (TA) 'Studies.'

The simple 'slider ball' can move a total of five notches starting from far left (Weak) to far right (Strong).

If the ball position has moved since the prior period, it will have a series of arrows behind it. If the arrows are on the left, that signifies a move from the left, from a weaker to a stronger position, and vice-versa.

Each detailed TA Study has its own slider ball indicator and consists of dozens to hundreds of individual calculations (collectively referred to as 'algorithms').

These detailed algorithms are aggregated and weighted to produce higher level Summary slider indicators until the top-level, overall score is attained.

Technical Analysis Point Score

(TAPS) Indicators

City: Deltona-Daytona Beach-Ormond Beach, FL

This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on that local market.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Real Estate Cycle Charts

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called "Studies" – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

Because real estate is so cyclical (compared to the Stock Market, for example), relatively simple Studies can be used to accurately track local markets.

Using these charts and Studies, HousingAlerts.com deciphers the data into two broad categories:

1) Market Momentum (the Six Trigger Alert Report or 'STAR')

and...

2) TA Point Score (TAPS)

Long Term Real Estate Cycles

City: Deltona-Daytona Beach-Ormond Beach, FL

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called “Studies” – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of "95%" means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of “95%” means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

to view

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

S.T.A.R. Momentum Gauge

This indicator measures and ranks (as a percentile, relative to ALL markets nationwide) each market's momentum. Momentum is important, but a high momentum score does not, by itself, indicate a hot market. Momentum scores are 'long range' indicators that should be used along with raw master/hot market scores and Wealth Phase charts.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets. Use 'Raw" scores for measuring the absolute performance.

T.A.P.S. Overall Gauge

This is the Technical Analysis Point Score ranking after combining the Local (city-level) market with the State, Regional and National TAPS scores.

The indicator below represents the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

1-Yr THAR Gauge

This indicator ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year. ‘THAR’ scores are ‘spot’ indicators that should be used with TAPS and Master Scores, not as stand-alone decision triggers.

The indicators below represent the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

STAR Indicators

The STAR momentum indicators show the 'energy' behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six 'triggers' represent a distinct Technical Analysis (TA) 'event.'

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) 'growing' from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

STAR Momentum Indicators

Market Momentum (STAR) Indicators

City: Denver-Aurora-Lakewood, CO

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six ‘triggers’ represent a distinct Technical Analysis (TA) ‘event.’

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) ‘growing’ from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

| Short-Term | Mid-Term | Long-Term | ||||

| #1 | #2 | #3 | #4 | #5 | #6 | |

| Current Qtr |  |

|

|

|

|

|

| Prior Qtr |  |

|

|

|

|

|

| 2 Qtrs ago |  |

|

|

|

|

|

| 3 Qtrs ago |  |

|

|

|

|

|

| Year ago |  |

|

|

|

|

|

TAPS Indicators

The TAPS (Technical Analysis Point Score) indicator is an easy to understand, graphical way to show the results of complex Technical Analysis (TA) 'Studies.'

The simple 'slider ball' can move a total of five notches starting from far left (Weak) to far right (Strong).

If the ball position has moved since the prior period, it will have a series of arrows behind it. If the arrows are on the left, that signifies a move from the left, from a weaker to a stronger position, and vice-versa.

Each detailed TA Study has its own slider ball indicator and consists of dozens to hundreds of individual calculations (collectively referred to as 'algorithms').

These detailed algorithms are aggregated and weighted to produce higher level Summary slider indicators until the top-level, overall score is attained.

Technical Analysis Point Score

(TAPS) Indicators

City: Denver-Aurora-Lakewood, CO

This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on that local market.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Real Estate Cycle Charts

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called "Studies" – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

Because real estate is so cyclical (compared to the Stock Market, for example), relatively simple Studies can be used to accurately track local markets.

Using these charts and Studies, HousingAlerts.com deciphers the data into two broad categories:

1) Market Momentum (the Six Trigger Alert Report or 'STAR')

and...

2) TA Point Score (TAPS)

Long Term Real Estate Cycles

City: Denver-Aurora-Lakewood, CO

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called “Studies” – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of "95%" means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of “95%” means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

to view

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

S.T.A.R. Momentum Gauge

This indicator measures and ranks (as a percentile, relative to ALL markets nationwide) each market's momentum. Momentum is important, but a high momentum score does not, by itself, indicate a hot market. Momentum scores are 'long range' indicators that should be used along with raw master/hot market scores and Wealth Phase charts.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets. Use 'Raw" scores for measuring the absolute performance.

T.A.P.S. Overall Gauge

This is the Technical Analysis Point Score ranking after combining the Local (city-level) market with the State, Regional and National TAPS scores.

The indicator below represents the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

1-Yr THAR Gauge

This indicator ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year. ‘THAR’ scores are ‘spot’ indicators that should be used with TAPS and Master Scores, not as stand-alone decision triggers.

The indicators below represent the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

What is a Wealth Phase?

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

For example, the green highlighted areas in the "Appreciation/Depreciation" chart below shows the Wealth Phases for San Diego.

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

STAR Indicators

The STAR momentum indicators show the 'energy' behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six 'triggers' represent a distinct Technical Analysis (TA) 'event.'

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) 'growing' from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

STAR Momentum Indicators

Market Momentum (STAR) Indicators

City: Des Moines-West Des Moines, IA

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six ‘triggers’ represent a distinct Technical Analysis (TA) ‘event.’

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) ‘growing’ from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

| Short-Term | Mid-Term | Long-Term | ||||

| #1 | #2 | #3 | #4 | #5 | #6 | |

| Current Qtr |  |

|

|

|

|

|

| Prior Qtr |  |

|

|

|

|

|

| 2 Qtrs ago |  |

|

|

|

|

|

| 3 Qtrs ago |  |

|

|

|

|

|

| Year ago |  |

|

|

|

|

|

TAPS Indicators

The TAPS (Technical Analysis Point Score) indicator is an easy to understand, graphical way to show the results of complex Technical Analysis (TA) 'Studies.'

The simple 'slider ball' can move a total of five notches starting from far left (Weak) to far right (Strong).

If the ball position has moved since the prior period, it will have a series of arrows behind it. If the arrows are on the left, that signifies a move from the left, from a weaker to a stronger position, and vice-versa.

Each detailed TA Study has its own slider ball indicator and consists of dozens to hundreds of individual calculations (collectively referred to as 'algorithms').

These detailed algorithms are aggregated and weighted to produce higher level Summary slider indicators until the top-level, overall score is attained.

Technical Analysis Point Score

(TAPS) Indicators

City: Des Moines-West Des Moines, IA

This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on that local market.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Real Estate Cycle Charts

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called "Studies" – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

Because real estate is so cyclical (compared to the Stock Market, for example), relatively simple Studies can be used to accurately track local markets.

Using these charts and Studies, HousingAlerts.com deciphers the data into two broad categories:

1) Market Momentum (the Six Trigger Alert Report or 'STAR')

and...

2) TA Point Score (TAPS)

Long Term Real Estate Cycles

City: Des Moines-West Des Moines, IA

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called “Studies” – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of "95%" means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of “95%” means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

to view

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

S.T.A.R. Momentum Gauge

This indicator measures and ranks (as a percentile, relative to ALL markets nationwide) each market's momentum. Momentum is important, but a high momentum score does not, by itself, indicate a hot market. Momentum scores are 'long range' indicators that should be used along with raw master/hot market scores and Wealth Phase charts.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets. Use 'Raw" scores for measuring the absolute performance.

T.A.P.S. Overall Gauge

This is the Technical Analysis Point Score ranking after combining the Local (city-level) market with the State, Regional and National TAPS scores.

The indicator below represents the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

1-Yr THAR Gauge

This indicator ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year. ‘THAR’ scores are ‘spot’ indicators that should be used with TAPS and Master Scores, not as stand-alone decision triggers.

The indicators below represent the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Real Estate Cycle Charts

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called "Studies" – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

Because real estate is so cyclical (compared to the Stock Market, for example), relatively simple Studies can be used to accurately track local markets.

Using these charts and Studies, HousingAlerts.com deciphers the data into two broad categories:

1) Market Momentum (the Six Trigger Alert Report or 'STAR')

and...

2) TA Point Score (TAPS)

Long Term Real Estate Cycles

City: Abilene, TX

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called “Studies” – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

STAR Indicators

The STAR momentum indicators show the 'energy' behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six 'triggers' represent a distinct Technical Analysis (TA) 'event.'

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) 'growing' from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

STAR Momentum Indicators

Market Momentum (STAR) Indicators

City: Abilene, TX

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six ‘triggers’ represent a distinct Technical Analysis (TA) ‘event.’

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) ‘growing’ from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

| Short-Term | Mid-Term | Long-Term | ||||

| #1 | #2 | #3 | #4 | #5 | #6 | |

| Current Qtr |  |

|

|

|

|

|

| Prior Qtr |  |

|

|

|

|

|

| 2 Qtrs ago |  |

|

|

|

|

|

| 3 Qtrs ago |  |

|

|

|

|

|

| Year ago |  |

|

|

|

|

|

TAPS Indicators

The TAPS (Technical Analysis Point Score) indicator is an easy to understand, graphical way to show the results of complex Technical Analysis (TA) 'Studies.'

The simple 'slider ball' can move a total of five notches starting from far left (Weak) to far right (Strong).

If the ball position has moved since the prior period, it will have a series of arrows behind it. If the arrows are on the left, that signifies a move from the left, from a weaker to a stronger position, and vice-versa.

Each detailed TA Study has its own slider ball indicator and consists of dozens to hundreds of individual calculations (collectively referred to as 'algorithms').

These detailed algorithms are aggregated and weighted to produce higher level Summary slider indicators until the top-level, overall score is attained.

Technical Analysis Point Score

(TAPS) Indicators

City: Abilene, TX

This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on that local market.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Current Market Conditions

These charts, maps and indicators represent the most currently available Technical Analysis ( "TA") of National, State and Local Real Estate Markets.

TA is visual, relying on Supply and Demand charts because these charts also track the most important and most elusive driver of future price trends: Market Psychology.

TA has become the dominant methodology for predicting stock, bond, commodity and currency market cycles worldwide and is used by ALL major investment banks and international trading desks as the underlying basis for TRILLIONS of dollars in DAILY investment transactions.

Real Estate Cycle Charts

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called "Studies" – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

Because real estate is so cyclical (compared to the Stock Market, for example), relatively simple Studies can be used to accurately track local markets.

Using these charts and Studies, HousingAlerts.com deciphers the data into two broad categories:

1) Market Momentum (the Six Trigger Alert Report or 'STAR')

and...

2) TA Point Score (TAPS)

Long Term Real Estate Cycles

City: Cape Coral-Fort Myers, FL

Charts showing the annual appreciation or decline in real estate values over time are visual snapshots of Supply and Demand forces in action. Technical Analysis (TA) relies on these charts because they accurately reflect what ACTUALLY happened.

The practice of TA consists of what are called “Studies” – different sets of calculations and algorithms proven over time. These Studies include Market Psychology, the most powerful driver of all.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

STAR Indicators

The STAR momentum indicators show the 'energy' behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six 'triggers' represent a distinct Technical Analysis (TA) 'event.'

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) 'growing' from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

STAR Momentum Indicators

Market Momentum (STAR) Indicators

City: Cape Coral-Fort Myers, FL

The STAR momentum indicators show the ‘energy’ behind any market. For a sustained up-cycle, it MUST be supported by momentum. Market Psychology influences momentum but is not the only driver.

The first step in locating investment candidates is evaluating the STAR indicators. Each of the six ‘triggers’ represent a distinct Technical Analysis (TA) ‘event.’

The left-most columns are Short-Term triggers and carry far less significance than the Long-Term indicators on the right.

However, all Trend Reversals (up or down) BEGIN with the short term triggers. They provide early-warning signals, especially when they develop a consistent pattern of changing colors (from green to red, or red to green) ‘growing’ from left to right.

Green means positive, upward sloping momentum. Red means the opposite. Yellow occurs when, in the current period, the slope/direction changed for that trigger.

Markets that do not display a consistent color pattern; with seemingly random horizontal color changes from one period to the next, especially in the long-term triggers, are generally lacking ANY momentum, and are poor investment markets for Leveraged Appreciation.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

| Short-Term | Mid-Term | Long-Term | ||||

| #1 | #2 | #3 | #4 | #5 | #6 | |

| Current Qtr |  |

|

|

|

|

|

| Prior Qtr |  |

|

|

|

|

|

| 2 Qtrs ago |  |

|

|

|

|

|

| 3 Qtrs ago |  |

|

|

|

|

|

| Year ago |  |

|

|

|

|

|

TAPS Indicators

The TAPS (Technical Analysis Point Score) indicator is an easy to understand, graphical way to show the results of complex Technical Analysis (TA) 'Studies.'

The simple 'slider ball' can move a total of five notches starting from far left (Weak) to far right (Strong).

If the ball position has moved since the prior period, it will have a series of arrows behind it. If the arrows are on the left, that signifies a move from the left, from a weaker to a stronger position, and vice-versa.

Each detailed TA Study has its own slider ball indicator and consists of dozens to hundreds of individual calculations (collectively referred to as 'algorithms').

These detailed algorithms are aggregated and weighted to produce higher level Summary slider indicators until the top-level, overall score is attained.

Technical Analysis Point Score

(TAPS) Indicators

City: Cape Coral-Fort Myers, FL

This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on that local market.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (raw)

The “RAW Master Score” is a proprietary algorithm combining the TAPS, STAR and other indicators into a single score. This is the best single indicator (if you only want to look at ONE scoring element).

A high score (with a green background) indicates a market in a strong phase of it's long term real estate cycle.

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of "95%" means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

Percentile Ranking Gauges

These gauges show the exact percentile (rank) of this market relative to all markets. A score of “95%” means that, for this indicator, 95% of ALL markets scored lower. 99% (Green) is the best, 0% (Red) is the worst. Typically, a Master Score in the Green area indicates a hot market.

Exit a market based on declining Master, TAPS and STAR scores, especially when new, emerging markets show much stronger relative strength. Follow the "Wealth Phase" chart (when it is no longer green) for the 'last' indicator on when to EXIT a market.

Before initiating a NEW investment or entering a NEW market, look for a high (green) Master, TAPS and STAR (momentum) scores combined with a 'green' Wealth Phase chart.

If you want to know more about HosuingAlerts just click here to learn more.

Close Tab

Close Tab

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

to view

Master Score (Percentile) Gauge

This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single score. The data below is the Percentile Ranking for each market's Master Score, RELATIVE to all similar markets.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance. Use these percentile scores in conjunction with the TAPS, STAR and Wealth Phase indicators.

S.T.A.R. Momentum Gauge

This indicator measures and ranks (as a percentile, relative to ALL markets nationwide) each market's momentum. Momentum is important, but a high momentum score does not, by itself, indicate a hot market. Momentum scores are 'long range' indicators that should be used along with raw master/hot market scores and Wealth Phase charts.

Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets. Use 'Raw" scores for measuring the absolute performance.

T.A.P.S. Overall Gauge

This is the Technical Analysis Point Score ranking after combining the Local (city-level) market with the State, Regional and National TAPS scores.

The indicator below represents the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

1-Yr THAR Gauge

This indicator ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year. ‘THAR’ scores are ‘spot’ indicators that should be used with TAPS and Master Scores, not as stand-alone decision triggers.

The indicators below represent the Percentile Ranking when compared to ALL markets nationwide. Note that percentile ranking are useful for measuring RELATIVE performance BETWEEN markets, not for measuring the absolute performance.

Close Tab

Close Tab

Matching your investing tactics and strategies to your local real estate market trends produces more deals with less risk, effort, and capital. Your micro market intelligence finds and targets those needle-in-a-haystack opportunities and dramatically increases your ROI while slashing your upfront acquisition and marketing costs. Learn more...

Help

Help