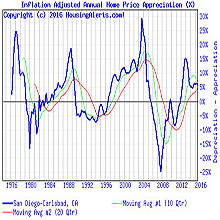

Population Growth ≠ Home Price Growth

If you were surprised to learn that the two U.S. metro markets with the highest population growth for 2022, 2023 and 2024 were also some of the WORST markets for Home Price Appreciation, then this might blow your mind…

Population Growth is NOT a Reliable

Predictor of Home Price Appreciation

Here are the eight fastest-growing U.S.