Click Here To Grab Your FREE Account NOW!

In our last blog post titled “The HOTTEST State for Real Estate”, we identify one state that is red-hot for investing right now.

In this article however, we’ll take a look at the WORST state for building real estate wealth. Its indicators show almost the polar opposite of the hottest state.

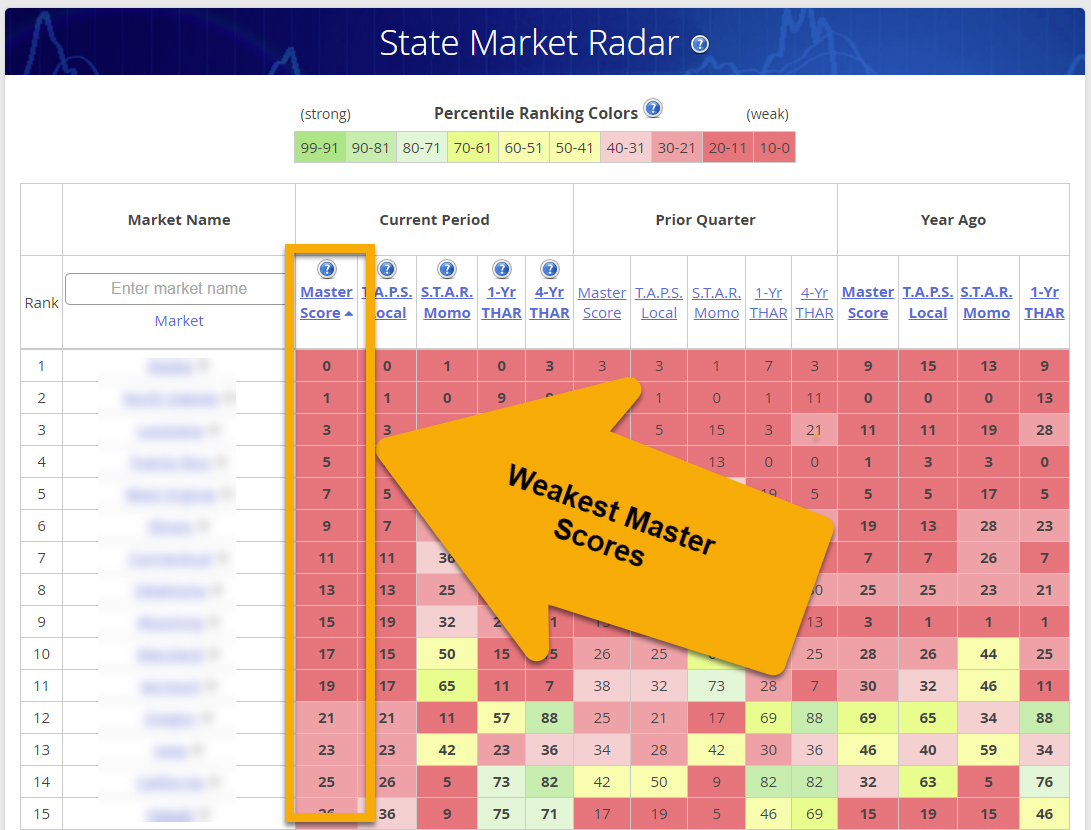

To find the weakest states, we started with our “State Market Radar” tool and ranked all the states according to their Master Score, lowest to highest. (The Master Score combines all of our metrics into one score.)

With this tool we can instantly see the worst (and best) states in the country with the click of a mouse!

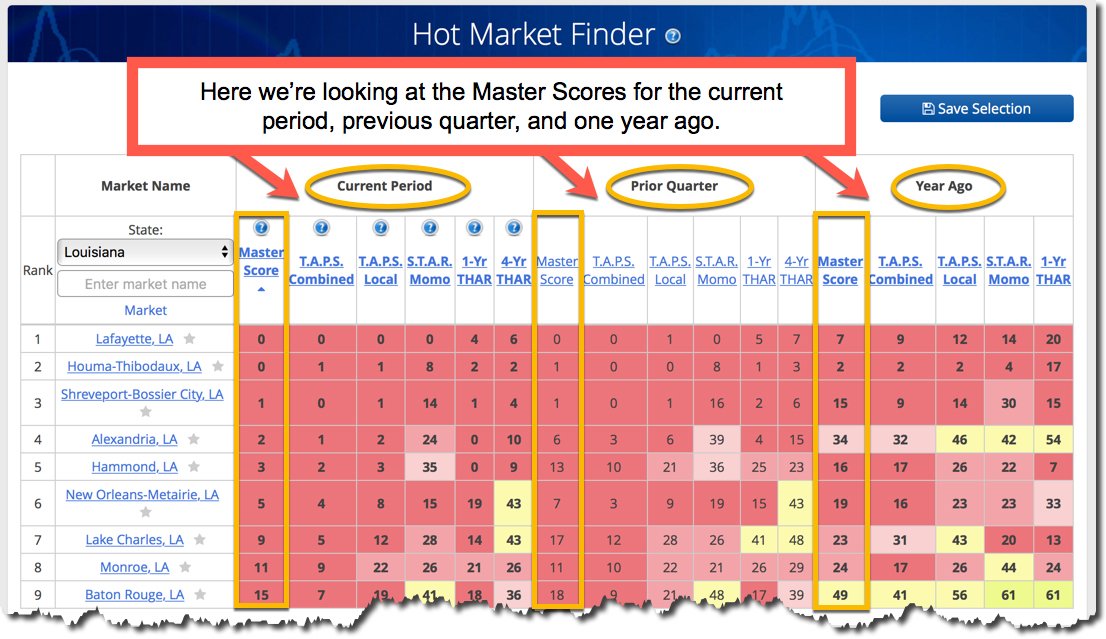

Once we decided on the ‘overall’ worst state (there are several to choose from) we then jumped over to our “Hot Market Finder” tool and used the drop-down filter to view only the markets INSIDE that state.

Below is a screenshot of the 9 main markets in this state. We highlighted the Master Score for each local market in that state, for all 3 time periods: Current, Prior Quarter, and the Year Ago period.

(The Master Score uses advanced algorithms to identify and rank markets using a scale of 0-99; 99 being the hottest, and 0 being the crummiest.)

You’ll notice that the Master Score score has declined in every single market from the year ago period.

Besides the low score itself, the fact they are getting worse; trending in the wrong direction, is NOT a good sign.

Our Hot Market Finder tool is available to all PRO account members, and you can sign up for less than a trip to the coffee shop!

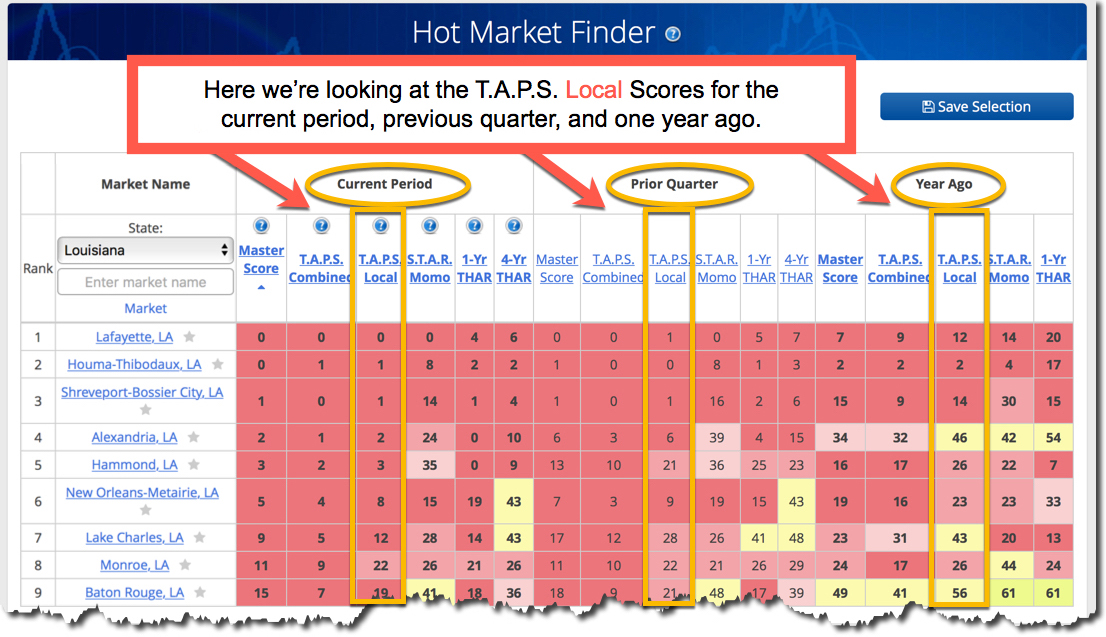

The next image below shows our Combined T.A.P.S score which factors in the Technical Analysis of the local, county, state, and national T.AP.S. scores.

If you’re not familiar with Technical Analysis, it’s a time-tested investing discipline used to predict the future direction of individual stock, bond, commodity and currency markets. We’re the originators and inventors of using Technical Analysis for predicting local real estate markets.

You’ll notice, just like the Master Score, the Combined TAPS score also got worse from the year-ago period for EVERY local market in this state.

The next column shows the Local T.A.P.S. score which, like the Combined score, uses Technical Analysis to assign a point value to the local market.

Again, every single market had a decrease from the previous year in this category.

The next column we’re looking at in the image below is the S.T.A.R. momentum tool. This indicator tracks the ‘long range’ momentum of a market. On its own, it’s not an indicator of a HOT market, but when used in conjunction with the T.A.P.S. and Wealth Phase chart, it can reveal quite a bit about the long-term outlook of a market.

Here we can see that all local markets in this state continue to have low momentum (STAR) scores. In fact, they’re getting worse in all but one market compared to the year-ago period.

In most cases, when a declining/crashing market has finally ‘bottomed out’ you’ll start to see significant and consistent INCREASES in its STAR score long before it becomes a hot, investable market again.

The fact that these markets continue to LOSE MOMENTUM relative to all the other markets in the country speaks poorly for its longer-term prospects as well.

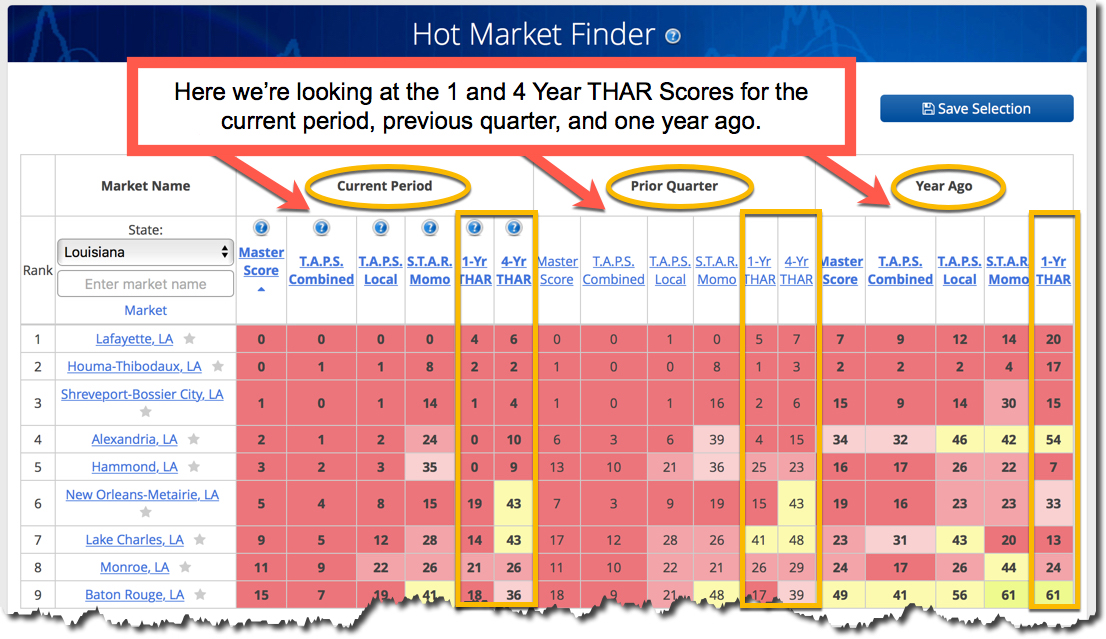

Lastly, in the image below you can see the 1-Yr and 4-Yr THAR (Total Home Appreciation Rate), which ranks each market relative to all US markets based on its 1-year and 4-year ‘raw’ total home appreciation.

And just like the other indicators, the THAR scores show very little promise for property appreciation in this state.

(Like the S.T.A.R. tool, the THAR indicators should be used in conjunction with the Wealth Phase charts and other indicators we provide, not as a stand alone decision trigger.)

As you can see, these indicators collectively paint a grim picture for the investment health of this state; it’s in the wrong phase of its real estate cycle to risk significant investment activities.

What’s the state you ask?

Louisiana.

Of course, ALL markets move in cycles and Louisiana isn’t the only state doing poorly right now. On the other hand, there are plenty of HOT and emerging markets all across the country right now.

YOUR real estate success is a function of knowing where to employ your time, talent and capital for the highest returns and the lowest risk and effort.

Your state might be headed in the wrong direction too, just like Louisiana… or it might be in the red hot part of its cycle, just like the state we showed you in our previous article.

If you have a HousingAlerts account, you’ll never need to invest blindfolded ever again!

Every HousingAlerts PRO account member gets all this information included with their membership.

Did you know that you can grab a PRO account for about $16/mo when you choose an annual account for your local market?

Check it out here to become a complete master of your market, today!

We have been rolling out some amazing new micro market tools for Wholesalers and Rehabbers. Our Neighborhood Ranking tool alone should save you thousands a month in targeted acquisition and lead generation costs. Click here to buy now.