We look at TWO broad categories (variables) to analyze a market:

a) Momentum (red, yellow, green STAR traffic signal icons)

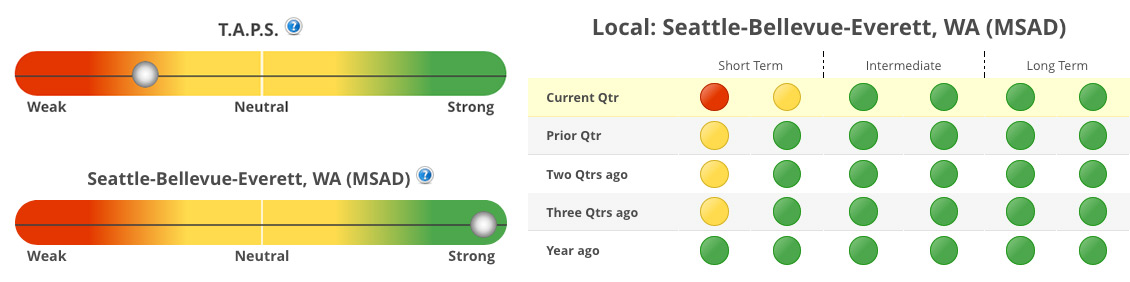

b) Technical Score (TAPS slider balls)

These are both important and INDEPENDENT variables. They do not always agree/align.

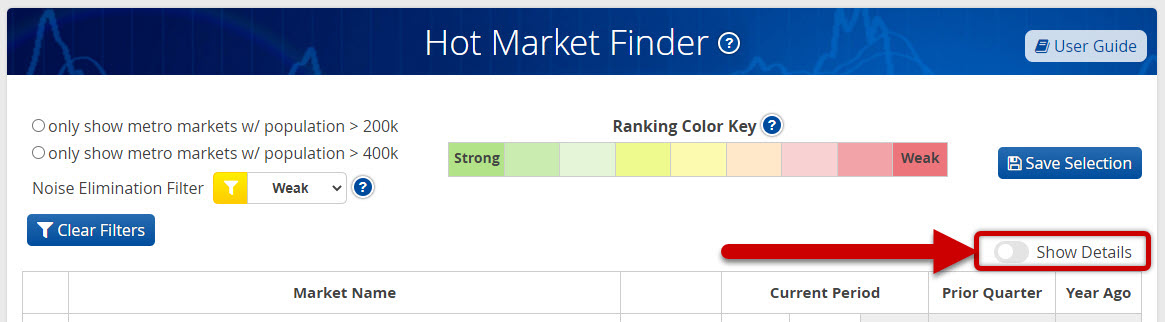

So with that as background, the easiest way to begin analyzing markets is to use the Hot Market Finder (‘HMF’) tool. There are several indicators on the HMF you can use to rank markets.

Click the “Show Details” button to expand the indicators mentioned below.

When ENTERING a new market, we want to see BOTH a strong STAR momentum indicator (lots of green, especially in the Intermediate and Long Term columns) and strong TAPS scores. A strong STAR score (along with a high TAPS score) makes it less likely the market will roll over and go negative any time soon.

The first step is confirming if your market is even in a Wealth Phase. Assuming it is, here’s a rough ranking of each of the Hot Market Finder (HMF) tool/indicator’s relative importance when ENTERING a new market:

- Wealth Phase

- Master Score

- STAR Momentum

- TAPS Combined

- TAPS Local

- 1 YR THAR

- 4 Yr THAR

Clicking on those Column Titles in the HMF shows where your market ranks in relation to all markets.

Once you are ALREADY invested in a market, because of the transaction cost and effort to EXIT a market, we are less concerned with the STAR indicator EXCEPT as an early warning indicator… it can give a year or more advance warning of a market reversal. (see this video for more, starting about 10 minutes in https://www.housingalerts.com/members/support/education/#taps-and-star-tutorial )

If the market is no longer in a (green) Wealth Phase, it’s a matter of figuring out ‘how bad is it?’

The Hot Market Finder is useful here as well, but with a slightly different weighting of the six indicators.

Here’s a rough ranking of each tool/indicator’s relative importance when contemplating the best time to EXIT a market:

- Wealth Phase

- TAPS Local

- 1 YR THAR

- Master Score

- TAPS Combined

- STAR Momentum

- 4 Yr THAR

Note that for EXITING a market, the STAR tool (momentum) is less important as a decision trigger compared to ENTERING a new market.

If you’re not ‘stuck’ in a single market, WHEN you leave a market is more a question of “OPPORTUNITY COST” rather than milking any single market for the last bits of appreciation.

In general, as a market accumulates more red STAR icons (losing momentum) AND the TAPS indicators are consistently getting weaker, it means the risks of decline are increasing; the likelihood of big appreciation is lessening. The risk/reward tradeoff isn’t as strong.

As a “Total Market Master” looking to ride appreciation waves from one market to the next, I focus more on the Hot Market Finder tool to track where my markets are RELATIVE to other markets nationwide (if you have access to those other markets). That way, I can jump into new, emerging markets that may offer significantly higher appreciation at lower risk.