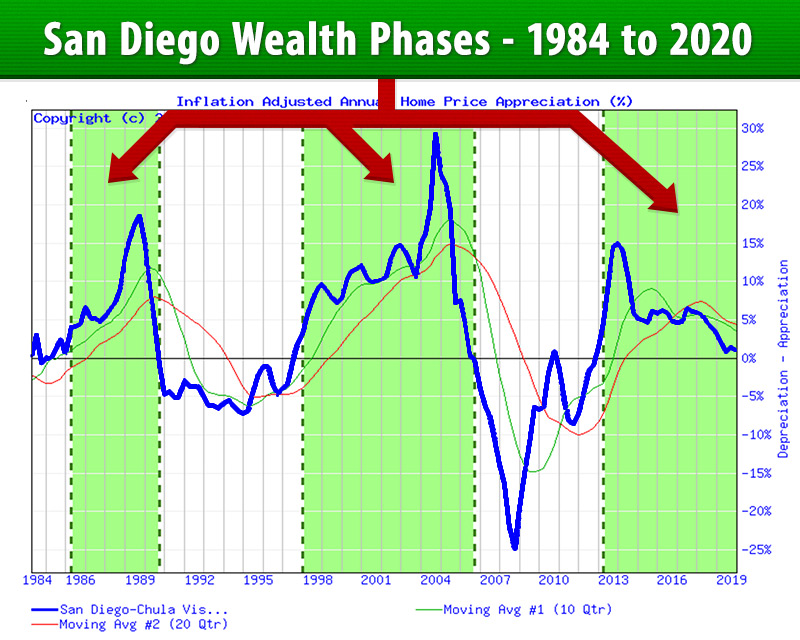

Simply put, Real Estate “Wealth Phases” are when you can make the most money with the least amount of effort, capital and risk.

This is because:

1) Real Estate values/prices are appreciating, and

2) Appreciating markets are VIBRANT; there are more buyers and sellers, deals are easier to do, real estate is (temporarily) more ‘liquid.’

Real Estate is Cyclical. All real estate prices rise and fall over time. These cycles occur at the LOCAL (city) level. EVERY local market is different. (There is no such thing as a “National” real estate market, only an average of hundreds of divergent local markets.)

At any given time, there are local markets in different parts of the cycle. It’s common to see local markets with double-digit annual appreciation while other markets are in steep decline. Increasingly, we’re seeing red hot, high appreciation markets in proximity to declining or crashing markets.

Owning or controlling leveraged real estate in DECLINING markets is the Kiss Of Death. The same leverage that builds wealth in rising markets, destroys wealth in falling markets.

Because of the “bad” (declining) part of the real estate cycle, trying to create wealth ignorant of these cycles – the “Wealth Phases” – is taking two steps back for every three forward.

Avoiding those recurring cyclical declines will build wealth and income many times over vs investing ‘blindfolded.’

The Wealth Cycle shown here is generated by sophisticated algorithms in ‘real time’ as data comes in. The green shading indicates the times when the LOCAL real estate cycle is best for wealth building and transactional income.