At the core of the HousingAlerts system is the Summary Market Scoring Report. This is a separate report for each market in your package – all in 1 page.

In this article, we’ll cover Market Rankings Gauges, STAR momentum indicators, TAPS slider ball, and Wealth phases.

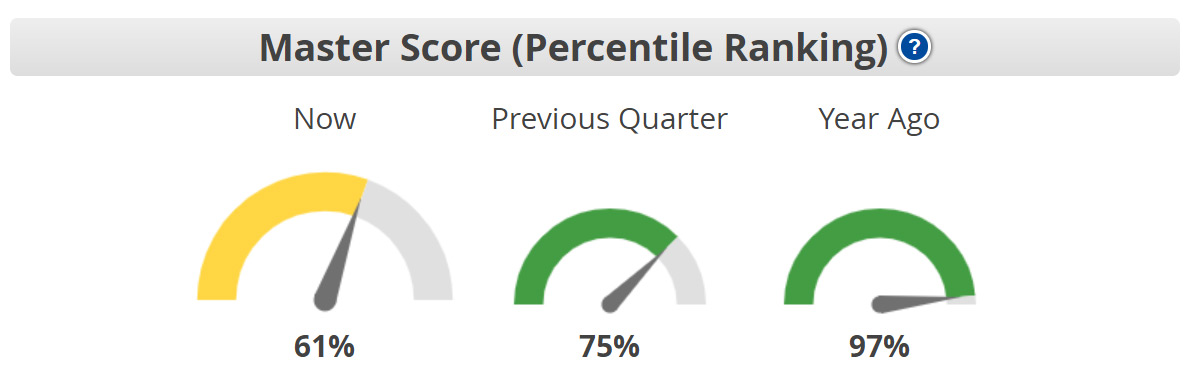

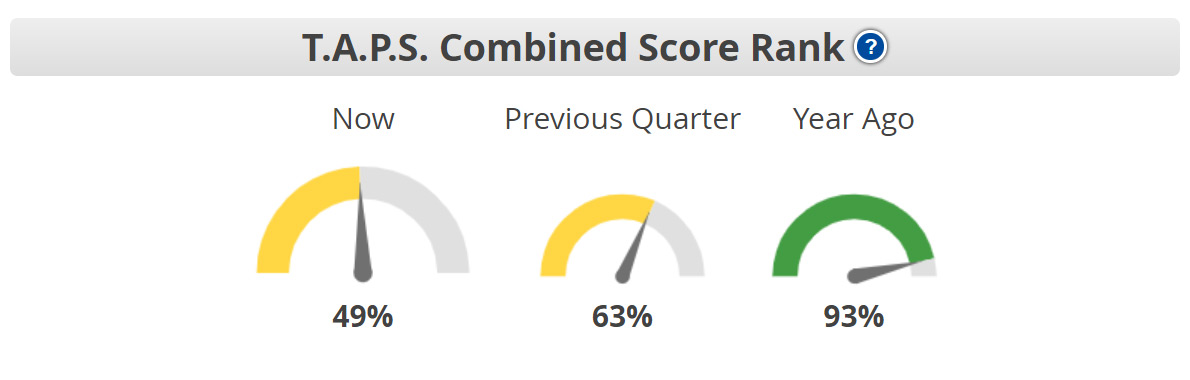

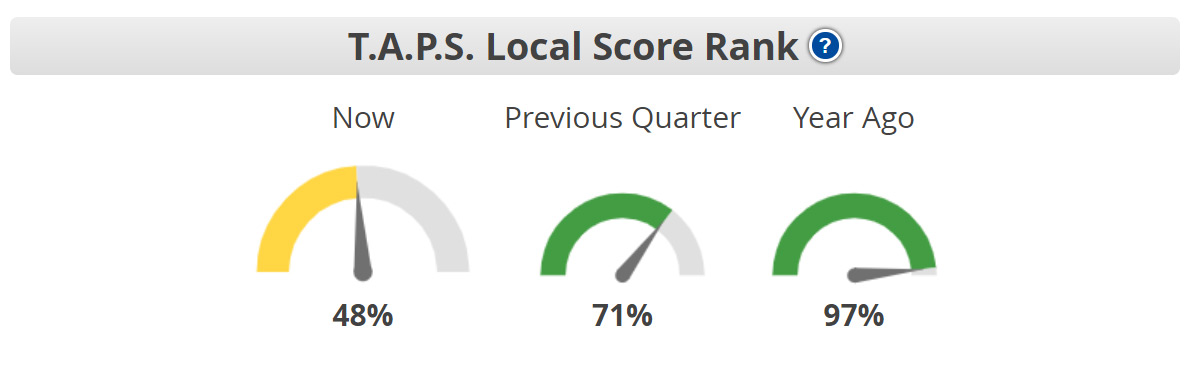

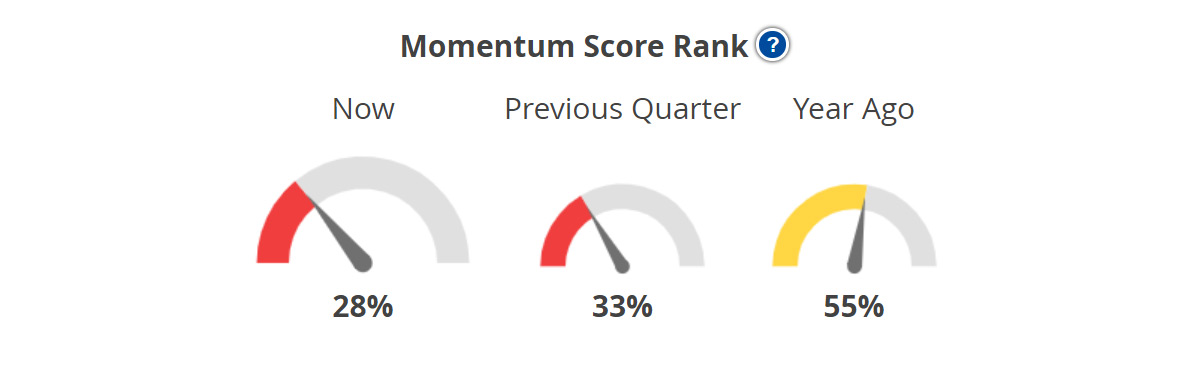

Market Rankings Gauges

This new tool is located in the Summary Market Scoring Report. An easy way to identify the hottest markets is to simply look for those scoring in the highest percentiles compared to all the other markets. A score of “90” means this market is higher than 90% of all markets for that particular criteria or score.

Master Score – This is the best single indicator (if you only want to look at ONE scoring element). The “Master Score” is a proprietary algorithm that integrates all data into a single indicator.

TAPS Combined Score – This is the Technical Analysis Point Score ranking after combining the local (city-level) market with the State, Regional and National TAPS scores.

TAPS – Local Score – This is the Technical Analysis Point Score ranking for ONLY that particular city. It ignores any impact State, Regional or National market TAPS scores may have on the local market.

Momentum Score – This gauge uses the STAR indicator tool to measure and rank each market based on its momentum.

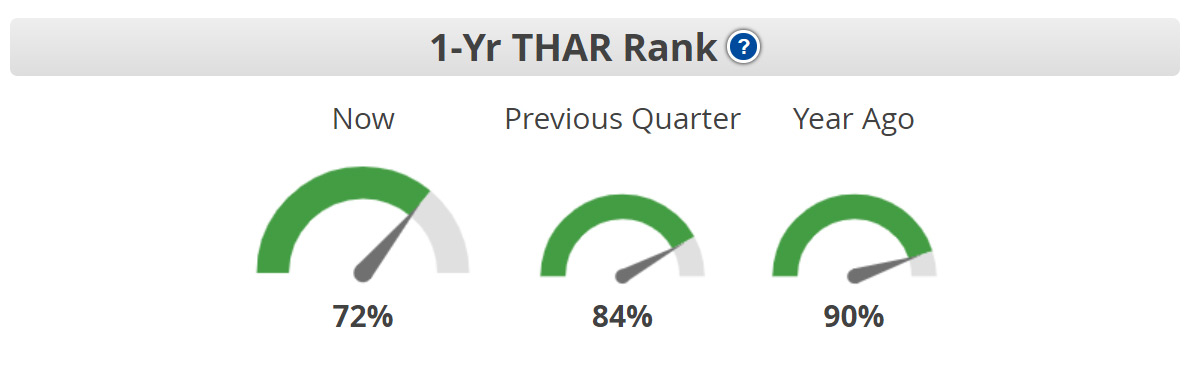

1-Yr THAR – This gauge ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous year.

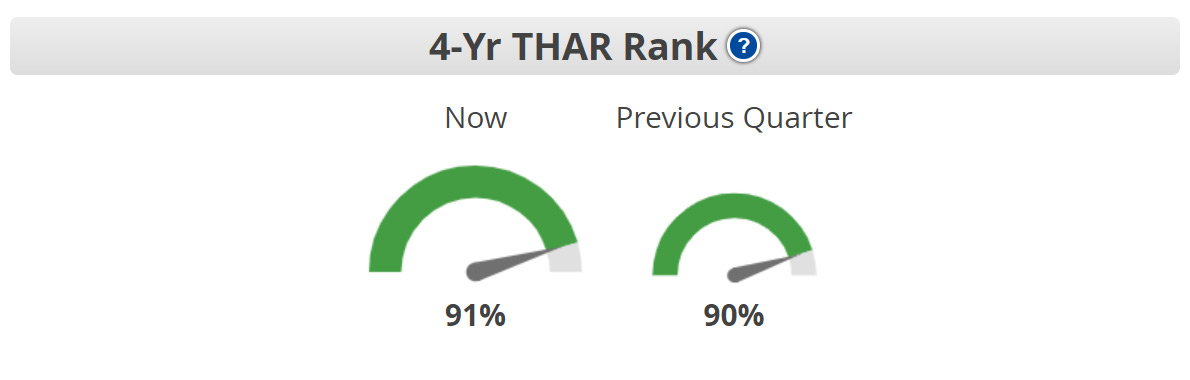

4-Yr THAR – This gauge ranks all markets based on its ‘raw’ Total Home Appreciation Rate over the previous four years.

STAR Momentum Indicators and TAPS slider ball

All the training information in the

STAR & TAPS article applies to the STAR Momentum Indicators and TAPS bars in the Summary Market Scoring Report.

Wealth Phase Charts – Buy/Sell Indicators

This is a great Q&A between Ken and one of our members, and will help understand when the indicators display a buy or sell signal.

Question:

During the wealth building phase chart while it shows green, but starts its decline, is this the time to sell or is it better to wait until the green phase ends and it starts to dip below the line? As I understand from the video tutorial, the market is still increasing during the entire phase of the green above the line part, but that it can be difficult to sell as the green phase is ending.

Answer:

You are correct: So long as the blue line is above the ‘zero’ line, the market is appreciating.

Once you are already invested, because of the transaction cost and effort to sell, I don’t get too concerned about minor up/down gyrations in the blue line so long as the TAPS indicators are showing at least neutral or better strength and the STAR indicator’s long term indicators are green.

I personally view the END of the Wealth Cycle as the “FINAL” confirmation indicator to sell (assuming you’re a “Local Market Master” and are not looking to invest in other hot, emerging markets.)

Usually, long before the Wealth Phase ends, the STAR and the TAPS tools BOTH start showing signs of weakening. Depending on your risk profile, market concentration/diversification, what’s happening in nearby markets, etc… you may not want to wait until the Wealth Phase chart comes to an end.

If you’re not ‘stuck’ in a single market, WHEN you leave a market is more a question of “OPPORTUNITY COST” rather than milking any single market for the last bits of appreciation.

In general, as a market accumulates more red STAR icons (losing momentum) AND the TAPS indicators are consistently getting weaker, it means the

risks of decline are increasing; the likelihood of big appreciation is lessening. The risk/reward trade-off isn’t as strong.

As a “Total Market Master” looking to ride appreciation waves from one market to the next, I focus more on the Hot Market Finder tool (rather than the Wealth Phase charts) to track where my markets are RELATIVE to other markets nationwide (if you have access to those other markets). That way, I can jump into new, emerging markets that may offer significantly higher appreciation at lower risk.Wealth Phase Charts – Colored lines – Moving Averages

How do we interpret the different combination of movements of the three lines in the Wealth Phase charts?

The “moving average” lines are used primarily to determine a market’s MOMENTUM.

The STAR Indicator tool (red/yellow/green traffic light icons) was designed to ‘interpret’ the Chart (and its Moving Average lines) to determine a markets momentum so you don’t have to become a chart reader/expert.

The relationship between the STAR tool and the Wealth Phase CHART is discussed in this video (starting around 10 mins in):

https://www.housingalerts.com/training/#taps-star-tutorial

It’s easier to reply in terms of STAR indicators than specific positions of the MA lines; they are largely one in the same.

We look at TWO broad categories (variables) to analyze a market:

a) Momentum (red, yellow, green STAR traffic signal icons)

b) Technical Score (TAPS slider balls)

These are both important, INDEPENDENT variables. They do not always agree/align.

When ENTERING a new market, we want to see BOTH a strong STAR momentum indicator (lots of green, especially in the Intermediate and Long Term columns) and strong TAPS scores. A strong STAR score (along with a high TAPS score) makes it less likely the market will roll over and go negative any time soon.

Here’s a rough ranking of each tool/indicator’s relative importance when ENTERING a new market:

- Wealth Phase

- Master Score

- STAR Momentum

- TAPS Combined

- TAPS Local

- 1 YR THAR

- 4 Yr THAR

Once you are ALREADY invested in a market, because of the transaction cost and effort to EXIT a market, we are less concerned with the STAR tool EXCEPT as an early warning indicator.

Here’s a rough ranking of each tool/indicator’s relative importance when EXITING a market:

- Wealth Phase

- TAPS Local

- 1 YR THAR

- Master Score

- TAPS Combined

- STAR Momentum

- 4 Yr THAR

Note that for EXITING a market, the STAR tool (momentum) is less important compared to ENTERING a new market.The above assumes you are ONLY interested in LV (ie – a Local Market Master).If you’re not ‘stuck’ in a single market, WHEN you leave a market is more a question of “OPPORTUNITY COST” rather than milking any single market for the last bits of appreciation.