Question:

Seems like the info is mainly based on how much an area will appreciate. We don’t buy that way. We base everything we do on cash flow with appreciation being a byproduct.

Answer:

With all due respect, this approach may, in my humble opinion, leave a lot of money on the table and cause excessive, uncompensated risks.

In other words, your returns on a risk-adjusted basis may be sub-par if you ignore appreciation.

While high cash flow markets are generally poor appreciation markets, that’s not always the case. There are rare but important exceptions to that rule.

Check out these articles:

- 10 Best Worst States for Cash Flow

- Finding Hottest Cash Flow Real Estate Markets

- How the 13 Original Colonies Real Estate Markes Look Today

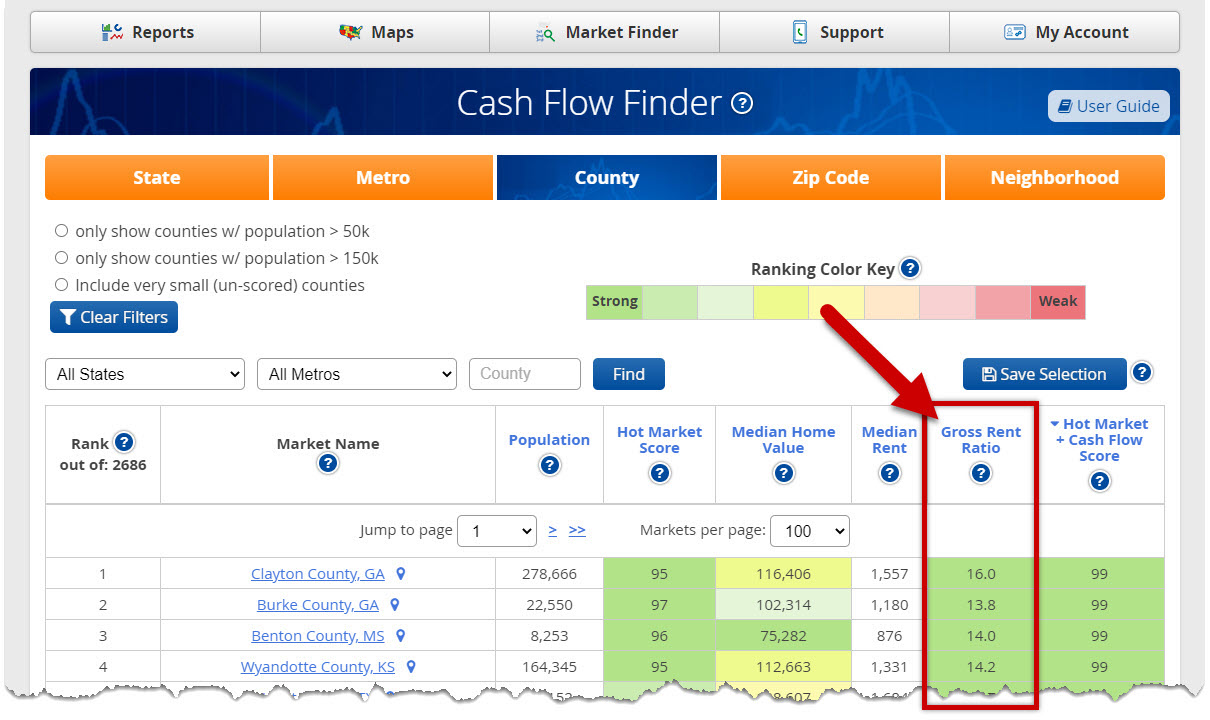

For example – if the ONLY thing you want is “positive cash flow”, here’s a list of the top 10 “Gross Rent Yield” counties in the US…

Any of those markets can give you decent cash flow. But that is NOT the same as decent profit or ROI.

So instead of ignoring ‘appreciation’ – you can stack the deck in your favor by ALSO

choosing markets that have BOTH high cash flow AND high appreciation

prospects. They are NOT always mutually exclusive… but it’s like finding the needle-in-the-haystack unless you have HousingAlerts (it’s what we specialize in doing).

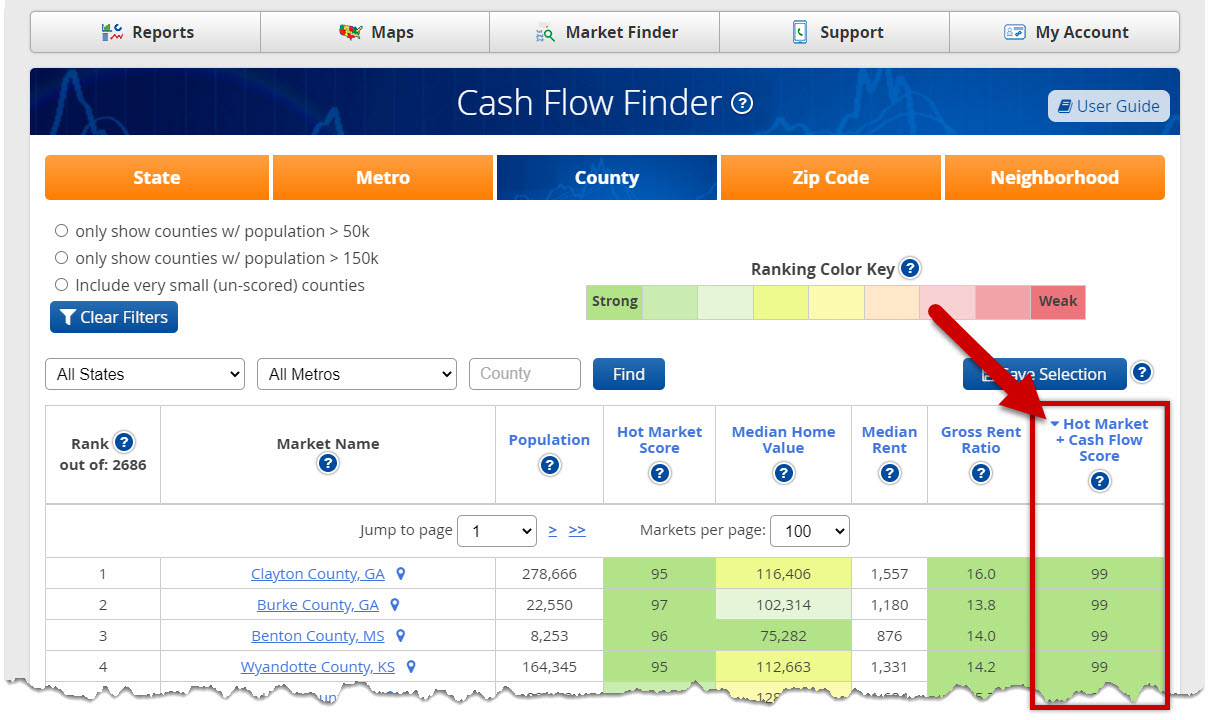

Here’s the same list, except this time it’s ranked by BOTH cash flow AND strong market.

Your TOTAL ROI will likely be many MULTIPLES higher when you combine cash flow AND strong appreciation.

There’s just no reason to ignore the appreciation component anymore.

We have a free “Sensitivity Analysis” tool on our public site if you want to easily run your own “best case/worst case” pro forma’s.

You’ll quickly see how most of your ROI comes from Appreciation, not cash flow.

The HousingAlerts Cash Flow Finder tool is only a small part of what we do.